What does the mobile game market look like as we approach 2023? What are the key trends you should pay attention to?

To find the answers to these questions, don’t rely on guesswork and assumptions.

Instead, rely on data.

We’ve gathered some of the most interesting mobile game market data provided by data.ai (formerly App Annie), and Sensor Tower to arrange this unit of 2022’s highlights and predictions for 2023.

On top of these numbers, we’ve added some of our own insights and observations.

Let’s get started.

Mobile Game Market’s First Decline Ever

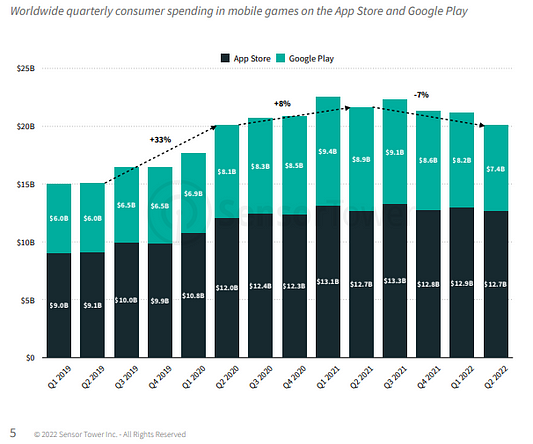

Source: Sensor Tower

It’s no secret that the mobile game market has been booming for years. Even the pandemic didn’t slow down its rapid growth.

Enters global recession.

In Q1 2022, the mobile game market experienced its first year-over-year decline in history, dropping by 6%. This trend continued in Q2 2022 when the revenues dropped from 21B to $20.1B (Sensor Tower).

To be completely fair, it’s not only the global living crisis that’s affecting these numbers.

The fact is, during the pandemic, the mobile game market reached unexpectedly high numbers. With those unusual circumstances behind us, it will be difficult to surpass the results that came out of them.

It’s interesting to note that it’s only the revenues that are dropping, while mobile game downloads remain stable. This tells us that reduced purchasing power is most likely the primary cause of the market decline.

What can we expect by the end of the year?

Sensor Tower predicts a 2.3% decrease in annual revenue. For the whole of 2022, they expect the mobile gaming industry will make a total of $86 billion.

Most Genres Drop, While Two Rise

Source: Sensor Tower

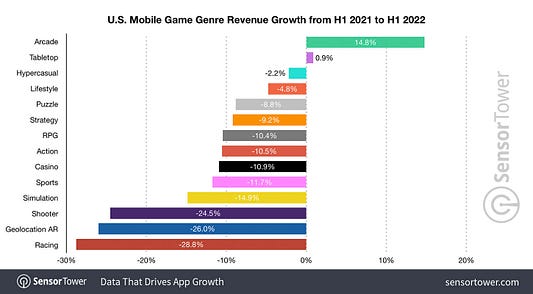

In the first half of 2022, the majority of mobile game genres flopped.

For particular genres, the situation was significantly worse than for others. Here’s which mobile game genres experienced the biggest drop in H1 2022, according to Sensor Tower:

- Racing (29.8%)

- Geolocation AR (26%)

- Shooter (24.5%)

It’s hard to say why it’s these three genres that faced the biggest decline.

However, it might have something to do with the fact that a lot of their revenues come from cosmetic purchases (e.g., skins and avatars). This is something players purchase merely to show off, but it doesn’t bring them a competitive advantage.

On a more positive note, there are two genres that saw a revenue increase in H1 2022 — arcade and tabletop games.

Why these two?

The most striking similarity between these two genres is that they are both considered classics.

One particular subgenre drove the success of the arcade genre — arcade idle games. In just over a year, this relatively new subgenre grew by a staggering 2050% (Sensor Tower and Homa Games).

Consumer Spend & Mobile Game Downloads

Source: Data.ai

What’s the difference between Google Play and App Store gamers?

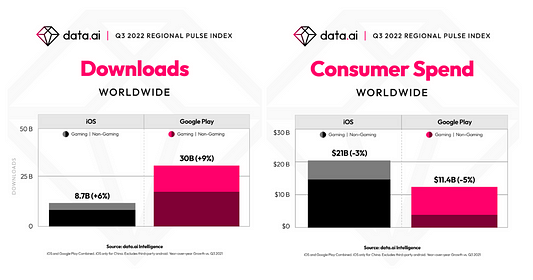

Here’s what the latest Games Index report by Data.ai tells us about this.

In Q3 2022, Google Play had a total of 30 billion downloads, and mobile games accounted for about half of all downloads. On the other hand, in the Apple App Store, mobile games make up for about one-third of its total 8.7 billion downloads.

Conclusion?

Android users play more games than iOS users.

We can also put it like this.

For every game downloaded on iOS, there are seven games downloaded on Android.

Android users also bring in more mobile game revenues — about two-thirds of Google Play’s $11.4B revenue comes from games. Meanwhile, iOS users are higher spenders in general, with a total revenue of $21B, more than half of which came from games.

You must be wondering — why is there such a gap between downloads and revenues in these two app stores?

This has a lot to do with the popularity of each app store in different countries. While Google Play is more popular in huge developing markets, the App Store is more popular in countries with stronger purchasing power.

Weekly Consumer Spend

Source: Data.ai

Have you ever thought about how much money mobile gamers spend each week?

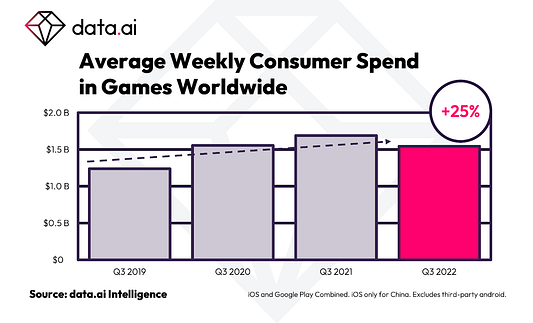

Here’s this information you probably never knew you needed.

During Q3 2022, mobile gamers spent $1.54 billion a week and downloaded 1.1 billion new games on their mobile devices.

Even though the numbers are lower than the year before, they are still 25% higher than in the pre-pandemic period.

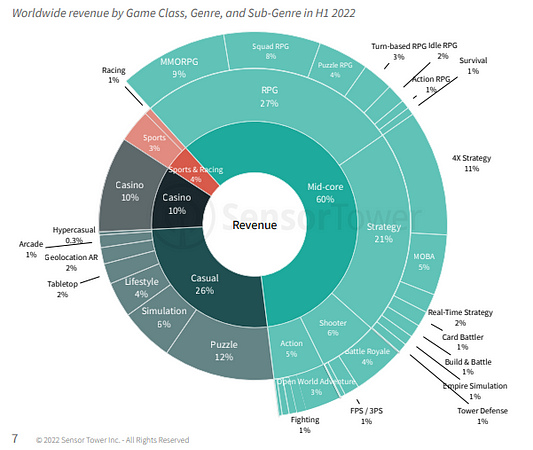

Mid-Core Games Drive Consumer Spending

Source: Sensor Tower

When it comes to downloads, casual games are a real force — they account for 78% of total app store downloads. Meanwhile, mid-core games are responsible for a weak 14% (Sensor Tower).

But, when it comes to revenues, things are much different.

In the first half of 2022, 60% of all mobile game revenue came from mid-core games. The two most profitable genres were RPG and strategy games, accounting for 27% and 21%, respectively (Sensor Tower).

On the other hand, casual games make up only 26% of the overall mobile game revenues.

There is more than one reason why mid-core games are such money machines.

Not only do these games typically attract dedicated audiences, but they also require a significant time investment by players and have challenging mechanics. Last but not least, they usually monetize through in-app purchases and subscriptions.

Leading Markets by Mobile Games Consumer Spend

In Q2 2022, the U.S. kept the leading position by consumer spend. It is followed by Japan, and China (only iOS revenue).

How is this different from last year?

According to Sensor Tower, compared to Q2 2021, U.S. player spending fell by 11%. Japan faced an even bigger drop, with a YoY decrease of 13%.

Meanwhile, other countries from the APAC region continued growing despite the global crisis, with both China and Taiwan growing by 4%.

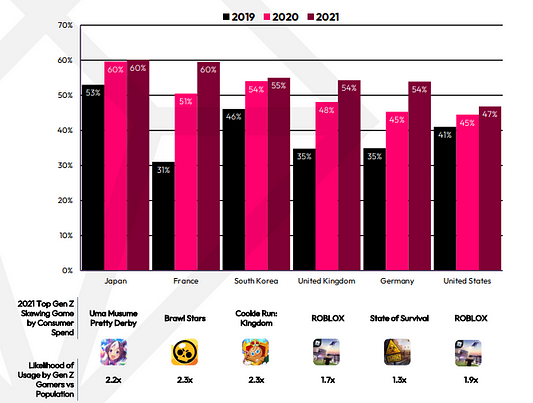

Gen Z — The Most Lucrative Gaming Audience

Source: Data.ai

The data from all the major markets shows that Gen Z gamers are the biggest spenders among the big age groups.

For this reason, developers are making more and more games tailored specifically for them.

Among the top 1000 top games by consumer spend, more than a half leaned towards Gen Z. Precisely, 60% of games in Japan and France, 55% in South Korea, 54% in the UK and Germany, and 47% in the U.S (Data.ai).

This probably left you wondering — what kinds of games does Gen Z spend money on?

Some of their favorite games in 2021 were ROBLOX, State of Survival, Cookie Run: Kingdom, Brawl Stars, etc.

As you can see, there is no particular pattern here. There’s Roblox, a virtual universe, two strategy games, and a multimedia franchise simulation game. This generation enjoys different types of games but craves unique and relatable features.

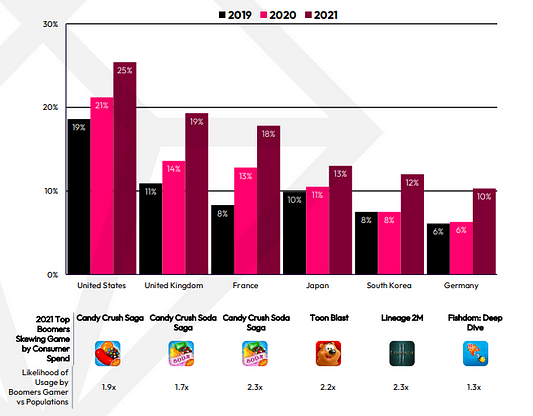

The +45 Group Grows in Consumer Spend

Source: Data.ai

The U.S. is a mobile game market where trends are born. For this reason, it is frequently quite different from the other regions.

In this market, it is noticeable that older users are starting to spend more on games. More precisely, Gen X and Baby Boomers.

For this reason, the share of top games by consumer spend geared toward these generations grew to 25% in 2021. This is increasing yearly, making them the fastest-growing category of spenders in the U.S.!

The elderly folks are mainly into match-3 titles. This includes games like Candy Crush Saga, Candy Crush Soda Saga, and Toon Blast (Data.ai).

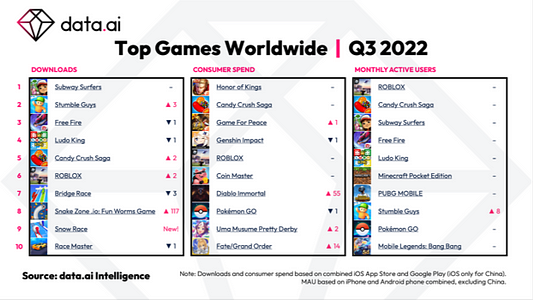

Mobile Game Market in Q3 2022: Top Games

Source: Data.ai

The best way to find out how the mobile game market “breathes” is to take a good look at the top charts.

Which mobile games did best in Q3 2022 in terms of downloads, consumer spend, and monthly active users? How much has changed from the last quarter?

Here come the answers to all these questions.

(All the data in this section comes from Data.ai’s latest Pulse Index).

Subway Surfers Remains #1 in Downloads

The top five games in Q3 2022 by downloads were:

- Subway Surfers (Casual)

- Stumble Guys (Casual)

- Free Fire (Action)

- Ludo King (Board)

- Candy Crush Saga (Match-3 Puzzle)

In Q2 2022, Subway Surfers reached 2 billion downloads and made history as the most downloaded game ever. The latest numbers show that the game is still going strong, keeping first place in downloads throughout Q3 2022.

The most notable change on this list is the rise of Stumble Guys. From the last quarter, the game climbed from the top ten to the top three. This casual multiplayer game appeared in 2021 and has remained at the top of the charts ever since.

None of these games would be able to get millions of downloads without a proper UA strategy. If you’re looking to boost downloads for your game, make sure to use the right ad networks.

A great place to find out which ad networks dominate the market is AppsFlyer’s Performance Index. In its 2022 edition, MyAppFree ranked as the world’s 6th fastest-growing mobile ad network.

Minor Changes in the Consumer Spend Chart

The top five games in Q2 2022 by consumer spend were:

- Honor of Kings (MOBA)

- Candy Crush Saga (Match-3 Puzzle)

- Game For Peace (Battle Royale)

- Genshin Impact (Action RPG)

- ROBLOX (Creative Sandbox)

In the previous quarter, Honor of Kings took over the first position in consumer spend from Genshin Impact.

Now, two other games came in between.

While it’s not surprising to see mid-and hardcore games switch the top spots, it’s interesting to see Candy Crush Saga rise to the top of this list. This proves that casual gamers can also be very engaged and willing to spend a lot of money.

Identical Monthly Active Users Rankings

The top five games in Q3 2022 by monthly active users were:

- ROBLOX (Creative Sandbox)

- Candy Crush Saga (Match-3 Puzzle)

- Subway Surfers (Casual)

- Free Fire (Action)

- Ludo King (Board)

As you can probably tell, this list includes a lot of the same titles as the downloads list. But what’s even more interesting is that not a single thing has changed from Q2 2022. ROBLOX keeps captivating Gen Z, while Candy Crush Saga holds onto its evergreen status.

Looking at the top 10 in all three categories, we noticed that there are two titles that appeared on all three lists — ROBLOX and Candy Crush Saga.

This shows that the studios behind these games do everything right — from UA to engagement and monetization. Therefore, if you’re looking for a textbook example to learn from, these two games are a great start.

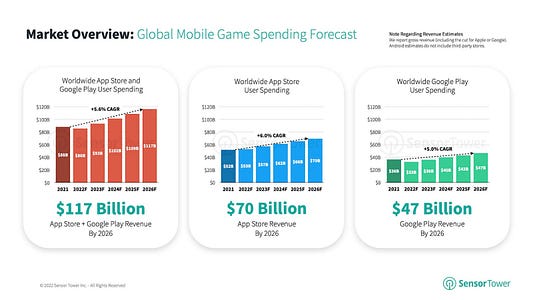

Mobile Game Market Forecast

Source: Sensor Tower

Okay, now you’re aware of the current state of the mobile game market. As you can see, it’s not all sunshine and rainbows.

But, what’s in the cards for it?

All predictions seem to agree on one — in the years to come, the market will grow again.

However, this will heavily depend on the macroeconomic and political climate, which makes any predictions uncertain.

According to Sensor Tower, the mobile game market is set for a decent rise in 2023. After dropping to $86 billion in 2022, they expect consumer spending to increase to $93 billion in 2023.

When it comes to the more distant future, the predictions are even more optimistic.

The market is predicted to grow at an annual growth rate of 5.6% until 2026 when it will reach $117 billion (Sensor Tower)

Wrapping up on the Mobile Game Market in Q3 2022

Hopefully, this article helped you understand the state and the trends in today’s mobile game market.

Want to read more articles like this one? We will continue analyzing and researching the mobile game market for you, so make sure to subscribe to our newsletter!